Understanding MSMEs To Help Them Succeed And Grow

The Five Stages of the Business Life Cycle

Consumers have a life cycle that involves events such as getting married, starting a family, and retiring. Customer-centric banks align to this life cycle to deepen their relationship by helping the customer solve their problems or achieve their dreams at the appropriate stage.

Businesses have a different life cycle that includes starting up, growing, maturing and possibly declining, and exit. In a similar way to consumers progressive customer-centric banks align their support to the business life cycle.

The stages of the business life cycle can be summarised as:

- 1. Start-up or launch stage;

- 2. Growth stage;

- 3. Maturity stage;

- 4. Renewal or decline stage;

- 5. Exit stage.

We'll examine each stage and the characteristics to help you understand their stage, and how retail banks can help them.

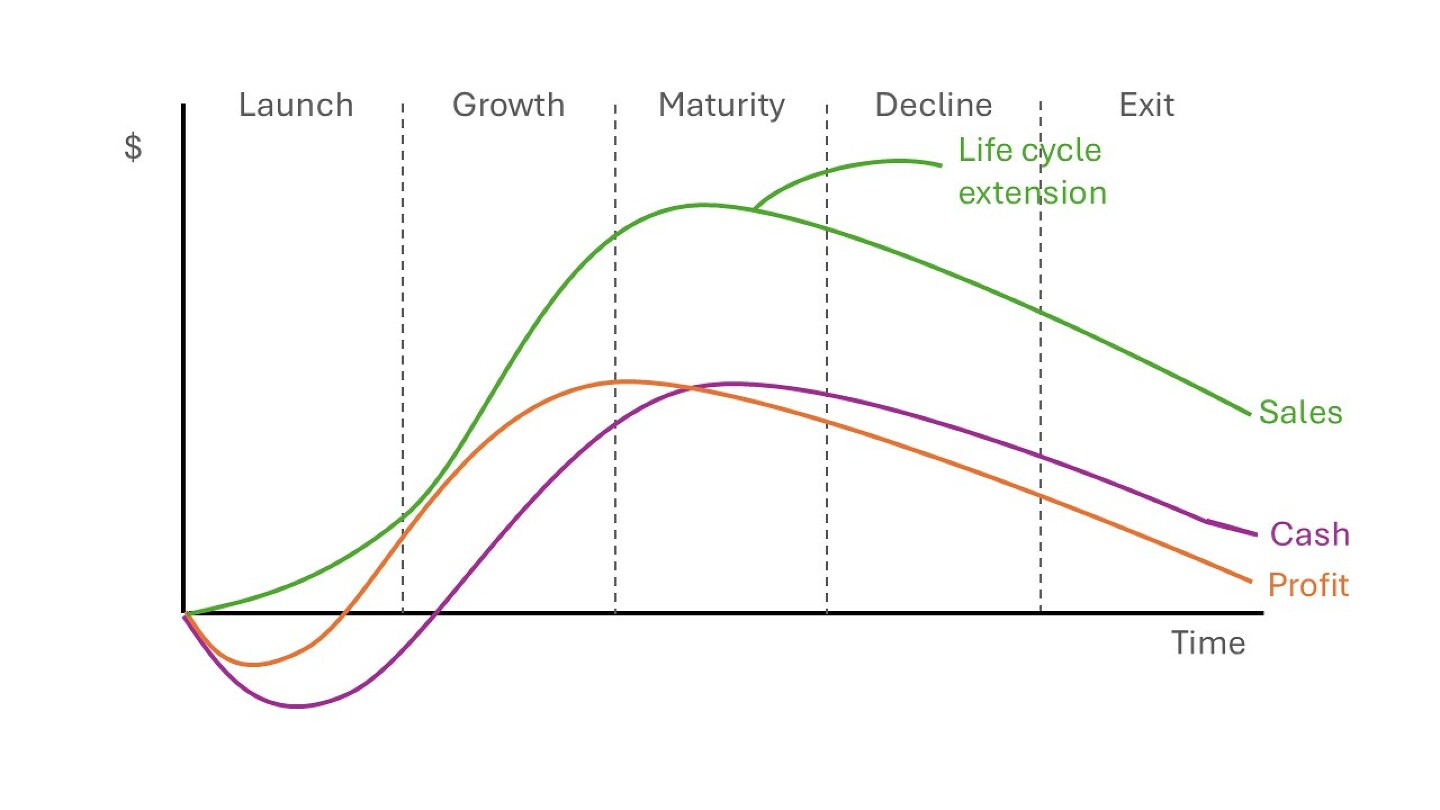

The following graphic from Corporate Finance Institute is helpful to understand the concept and its effect on the business' cash flow and profitability – which are not the same. Note that 'launch' often results in financial losses and the prospect of cash quickly running out.

Before we start: "In business: nothing is certain"

Starting and running a business is risky. The best laid plans can be derailed by many factors including economic uncertainty, competitors, and changing consumer tastes or behaviour.

Start-ups can go into decline and exit if they don't achieve sufficient growth early on or achieve maturity quickly. Mature businesses can decline and exit rapidly if they can't keep re-inventing themselves to stay relevant to their customers.

It means that not all businesses have the same needs as they move through their individual life cycle as their own pace, with no set time for phases.

Some businesses may appear to be struggling in perpetual start-up/launch mode where their product or service cannot achieve rapid sales growth, often because of their product has little market demand, or they have inadequate funding to spend on marketing and promotions to generate growth.

Businesses may prematurely enter decline because of the same reasons, or by not reacting to shifts in their market caused by new entrants or changing customer tastes.

Here are the typical life cycle stages, their characteristics and how banks can assist them:

Start-up or Launch Stage

Every business begins by launching new products and services, targeting specific customer segments through marketing and advertising. During this initial phase, sales are typically low but are expected to grow steadily. Due to high start-up costs and limited revenue, most businesses operate at a loss during this period. Cash flow is often negative, as initial investments may not immediately reflect in profit figures, but they significantly impact cash availability. Since cash flow represents the difference between sales revenue and business expenses such as rent, stock, salaries, and utilities, it is a critical financial indicator for start-ups.

At this stage, business risk is at its highest. Many start-ups struggle to secure debt financing because their business models (if they document it) are unproven, making repayment uncertain. However, as sales grow and businesses establish themselves, their ability to access funding also improves. The success of this phase largely depends on the entrepreneur's ability to manage cash flow, operating costs, attract customers, and gradually build financial stability.

Start-up Business Characteristics

A start-up business has several defining characteristics. First, most entrepreneurs rely on their own capital, family and friends, government grants, or alternative funding sources, as external investors and banks often hesitate to finance unproven businesses. Second, revenue is limited in the early stages while costs remain high. Businesses must invest in stock, marketing, and establishing relationships with suppliers and customers, all before significant sales occur. Marketing and promotion are particularly essential but can be costly.

A critical priority for any new business is establishing a strong customer base. Entrepreneurs must identify and reach their target audience, as outlined in their business plan. Successful customer acquisition strategies can determine how quickly a business moves beyond the high-risk start-up phase.

Banks play a crucial role in supporting start-ups. They offer various financial products, including start-up loans, micro-loans, and credit lines, to help businesses cover their initial expenses and strengthen their working capital. Additionally, banks provide educational resources through workshops, seminars, and online materials, equipping entrepreneurs with essential skills in financial literacy, business management, and entrepreneurship.

Start-up Support from Banks

To further support start-ups, banks often offer discounted business banking accounts with minimal fees, as well as digital banking solutions that streamline transactions and financial management. These services help new businesses manage their finances more efficiently and focus on growth. Banks typically have limited loan options for start-ups because new businesses lack a financial track record and collateral. However, some banks do offer 'start-up loans', often backed by government guarantees or special funding programs. Additionally, banks may provide business credit cards, overdraft facilities, and equipment financing to help start-ups manage cash flow. Alternative lenders, microfinance institutions, and government-backed programs often play a larger role in funding early-stage businesses than traditional banks. In the UK, for instance, there has been a rise in standalone specialist SME banks in recent years.

Surviving the Start-up Stage

Overall, the start-up stage is one of the most challenging stages in a business's lifecycle. Entrepreneurs must navigate financial constraints, build customer trust, and prove their business viability. With the right support, including financial assistance and business education, they can improve their chances of long-term success.

Growth Stage

Once an MSME moves beyond the start-up phase and proves its viability, it enters the growth stage, where revenues become more stable, and the customer base expands. This phase is characterised by rapid sales growth, leading to higher profits once the business surpasses its break-even point. However, since profit lags behind sales in the business cycle, earnings remain lower than total sales. With increased revenue, cash flow should become positive, meaning the business generates more cash than it spends. Positive cash flow allows for reinvestment and reduces financial strain on the business and its owners.

At this stage, business risk decreases, as steady sales and profitability provide evidence of the company's ability to manage its financial obligations. This makes it easier to raise capital through loans or investments. Many businesses seek additional funding to expand operations, enter new markets, or diversify their product and service offerings. However, while some businesses flourish, others struggle to transition from the start-up phase and may stagnate due to financial constraints, poor management, or market limitations.

Growth Phase Characteristics

A business in the growth stage exhibits several key characteristics. Revenue stabilises, replacing the erratic income pattern seen in the start-up phase. Ideally, as marketing and promotional efforts gain traction, the customer base expands, resulting in increased sales and brand recognition.

To support increased demand, businesses must scale operations, which may involve moving from a home-based setup to a dedicated business location, increasing production capacity, and hiring employees. This expansion often requires additional working capital, particularly in industries that rely on inventory. Working capital is financed to bridge the gap between purchasing stock and receiving revenue from sales. Companies like Tencent and Alibaba have successfully addressed this issue in underserved markets by using real-time payment and supply chain data to offer short-term working capital solutions and merchant cash advances.

Growth Stage Support from Banks

Most businesses in this phase require financial assistance to sustain and accelerate growth. Growth stage financing from banks comes in various forms, including business expansion loans linked to specific projects, working capital overdrafts, trade finance credit lines, and asset-based financing for purchasing equipment, such as machinery or delivery vehicles. These financial products enable businesses to expand their production capacity and meet increasing demand.

In addition, banks offer cash management solutions to help businesses optimise their financial operations. Services such as receivables financing, invoice factoring, and payment processing solutions to improve cash flow and provide more flexible payment options.

A significant challenge for MSMEs, especially smaller ones, is a lack of professional guidance at a reasonable cost. Banks can support businesses by facilitating mentorship and networking opportunities, connecting entrepreneurs with industry experts, investors, and potential business partners. Such support helps businesses refine their strategies, access new markets, and build resilience.

Finally, banks can enhance efficiency by integrating technology solutions into their services. Many small businesses use digital tools for bookkeeping, invoicing, and cash flow management that streamline financial management.

Scaling Up: The Key to MSME Growth and Success

The growth phase is a pivotal stage for MSMEs, requiring strategic financial management and external support. With the right banking services and business strategies, MSMEs can transition into established, competitive enterprises.

Maturity Stage

As a business matures, sales begin to plateau or decline, profit margins shrink, and cash flow remains relatively stable. Unlike the growth phase, where businesses experience rapid sales increases, maturity can bring stagnation in revenue and profitability. However, at this stage, major capital expenditures have typically been made, meaning cash flow may be higher than reported profits on the income statement.

To extend their life cycle, many businesses reinvent themselves by diversifying their product offerings, investing in new technologies, or expanding into new domestic or international markets. These strategic moves help businesses refresh their growth and remain competitive. Despite declining sales, mature businesses benefit from lower business risk, making it easier to access debt capital for expansion or transformation.

Maturity Stage Characteristics

At this stage, businesses experience stable revenue and profits. After periods of rapid growth, their income stabilises, and they no longer see dramatic increases in sales. However, profitability remains steady, and financial performance is predictable. Many businesses also reach maximum market penetration in their local or domestic regions, forcing them to seek new avenues for expansion. Since they have captured most of their target audience, they must now explore alternative strategies for increasing revenue.

With growth slowing, businesses shift their focus to efficiency and competitiveness by optimising operations, cutting costs, and finding new ways to maintain profitability. This often includes automating processes, improving supply chain management, or negotiating better deals with suppliers. Many mature businesses also consider diversification, leveraging their well-established brand to introduce new products or services. However, any diversification efforts must align with their brand identity and customer expectations to be successful.

To sustain long-term growth, businesses often seek new markets or products. This can mean expanding into international markets, targeting a different customer segment, or revisiting previous innovations. Entering new markets or developing new products requires businesses to reapply the strategies and techniques they used during their start-up and growth phases. These initiatives also demand significant investment, as businesses must allocate resources to research, development, marketing, and infrastructure upgrades. Expansion can strain a company's financial resources, making external funding essential.

Maturity Stage Support from Banks

Banks provide critical financial and strategic support to businesses at this stage. They offer business expansion capital, including long-term loans, equity financing, and venture capital, to help businesses grow into new markets or product lines.

Mature businesses require more customised financial solutions to manage their operations effectively. Banks offer specialised services such as real estate financing, equipment leasing, and advanced cash management to optimise financial performance. Additionally, as businesses expand, they must protect their assets, revenue, and reputation. Banks provide risk management solutions, including insurance, hedging strategies, international trade finance, and foreign exchange services, to safeguard against potential financial risks.

Thriving in Maturity: Sustaining Growth and Innovation

The maturity phase presents both challenges and opportunities. While revenue growth slows, businesses have the chance to reinvent themselves, expand strategically, and improve operational efficiencies. With proper financial support and strategic planning, they can extend their business life cycle, ensuring long-term sustainability and profitability.

The Renewal or Decline Stage

The penultimate stage of a business occurs when it fails to adapt to changing market conditions, leading to a decline in sales, profits, and cash flow. Without the ability to extend its life cycle, a business loses its competitive advantage and eventually exits the market. Rapidly declining sales signal that the company has struggled to respond to evolving customer needs, market shifts, or technological advancements. Businesses that recognise these challenges early may attempt renewal strategies to regain relevance and sustain profitability.

Renewal or Decline Stage Characteristics

A business in decline often experiences stagnation in revenue over an extended period. Growth, diversification, or expansion strategies may have failed, leaving the company with limited avenues for improvement. Market saturation or increased competition can further strain profitability, making it difficult to sustain operations without depleting capital. Businesses that cannot compete effectively may decide to exit the market or part of it rather than continue incurring losses.

To avoid closure, companies must embrace innovation or restructuring. If they have not previously invested in new markets or product lines, they may attempt to do so at this stage. However, the later this effort begins, the more challenging it becomes to achieve a successful turnaround. Some businesses manage to renew themselves by adapting to emerging consumer trends, leveraging new technologies, or refining their business model. Others struggle to implement change effectively and ultimately fail.

Renewal or Decline Stage Support from Banks

At this stage, banks assess whether a business can be salvaged or if it is too risky to support further. If a business has existing loans, banks may consider turnaround assistance in the form of restructuring loans or advisory services to avoid losses in the short-term. This support is typically reserved for larger companies that demonstrate the potential to recover. In such cases, restructuring often involves significant changes, including new leadership, revised strategies, or operational overhauls to align with market demands.

For businesses with viable prospects, banks may offer innovation funding to support research and development, product diversification, or market repositioning. However, banks will only invest in companies that show clear potential for recovery and growth.

End of the Road?: When Businesses Close

Businesses that fail to secure financial support or successfully implement renewal strategies often exit the market, marking the end of their business cycle.

Business Exit Stage

If a business fails to complete the renewal stage, it will continue to decline, ultimately leading to a business exit through a sale, merger, or closure. The severity of the situation determines whether business owners can plan an exit or are forced into one due to financial distress and creditor pressure.

Business Exit Stage Characteristics

Business owners who anticipate an inevitable decline may attempt to sell the company, merge with another business, or run-down and close operations in a structured manner. Creditors expect to be repaid in full, and if the business cannot meet its financial obligations, legal action may be taken by them to recover as much of their debt as possible. In cases where owners fail to manage a planned closure, creditors, including banks owed money, may force the business into receivership and or liquidation to recover outstanding debts.

During the exit process, owners will aim to maximise the value of remaining assets to ensure a smooth transition. If there is a surplus after settling debts, they will seek to retain as much capital as possible for personal or future business ventures.

Exit Stage Support from Banks

Banks typically assist with exit strategies for medium-sized or larger businesses or where they have significant lending at risk. If the business owner stands to gain substantial wealth from a sale or merger, banks may also provide specialised financial services. These can include wealth management that offers financial planning and tax advisory services to help owners manage personal wealth post-exit.

Banking on Growth: Supporting MSMEs at Every Stage

By understanding the unique needs at each stage of the business lifecycle, retail banks can offer targeted solutions and support that help MSMEs navigate challenges, capitalise on opportunities, and achieve sustained growth.