Fintech Insights for Retail Banks

In the last 10 years, fintech has transformed the direction of retail banking. In some cases, it has gone full circle, as fintechs have become (digital) retail banks. Most fintechs started as disruptors, and they’re now shifting to partnerships and strategic collaboration. That’s not entirely the choice of fintechs: in fact, the entire retail banking landscape has moved towards ecosystems and partnerships. The problem? Not every bank is able to join the ecosystem. But traditional banks now face a critical choice: adapt through innovation and partnership, or risk declining relevance in an increasingly digital-first marketplace.

The reality is that fintechs and neobanks have come to life in a new digital era, with digital ecosystems built on smartphones, cloud computing, digital platforms such as Instagram and TikTok, and always-online customers. But many fintechs then realise the advantages of a bank licence, and the importance of lending and financial intermediation.

This struck us forcefully when reading It’s About Tyme, the story of the South African retail bank that is the fastest digital bank to reach profitability. TymeBank recognised that the fastest-growing new digital banks such as MyBank and WeBank are embedded in much larger digital ecosystems. Dieter Botha, the CEO of TymeX (the bank’s tech team) speaks of how banking has changed, and it’s not about ‘sweating the assets’ anymore. “It’s no longer just a machine. It’s a garden. You’re grooming an ever-moving network of partners, platforms and parts. That’s banking in 2025.”

The Collaboration Imperative

The most successful banks recognise that fintechs are no longer just competitors but potential partners offering complementary strengths. Fintechs are great at agility, customer experience, and technological innovation, while traditional banks have deep regulatory expertise, and hard-earned trust. So there can be a natural synergy where banks can leverage fintech innovation to accelerate digital transformation whilst fintechs gain credibility, capital, and regulatory support.

Banking-as-a-Service partnerships exemplify this collaboration, allowing banks to extend their reach whilst fintechs rapidly bring solutions to market. Open banking regulations are turbocharging these partnerships by mandating data sharing through APIs, enabling innovative third-party services to build on top of traditional banking infrastructure.

Cost and Customer Experience Advantages

TymeBank also recognised that leaders run lean. Fintechs and neobanks achieve operational efficiency that traditional banks struggle to match, running at cost-to-income ratios near 30 percent compared to traditional banks' 55 percent. Their cost-to-serve customers can be 60-85 percent lower due to digital onboarding, automated processes, and cloud-native platforms.

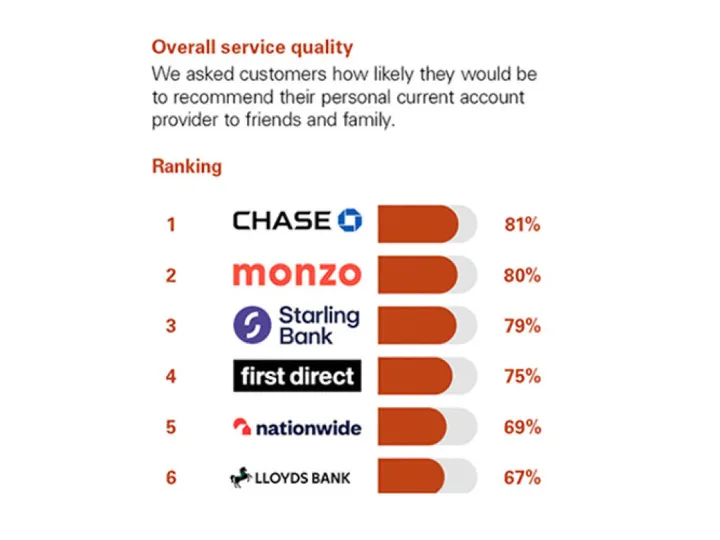

Customer satisfaction data underscores this advantage. We repeat this often: traditional banks in the UK with big branch networks have been amazed to be outpaced by digital banks in customer service surveys. In the image above you can see the results of the latest survey, with digital first banks on top.

Digital-first banks consistently outperform traditional institutions in satisfaction surveys, offering faster, more convenient, and personalised services. This trend is particularly pronounced among younger generations who prioritise mobile-first experiences, transparent pricing, and simplified processes over physical branches.

Strategic Response for Traditional Banks:

To remain competitive, retail banks must pursue several key strategies:

Digital Transformation means moving beyond superficial digitalisation to fundamentally reimagine processes from a digital-first perspective. This means avoiding the trap of simply digitising existing legacy processes, which creates clunky hybrid experiences.

Customer-Centricity Over Product-Centricity means shifting from pushing products to understanding and anticipating customer needs through AI-driven analytics and personalised recommendations. Banks must broaden and deepen relationships by offering integrated financial ecosystems spanning payments, lending, investments, and wealth management.

Branch Reinvention means transforming physical locations from transaction centres into advisory hubs focused on complex services like mortgages, business banking, and wealth management, whilst routine transactions migrate to digital channels. Not all banks are looking to close branches: branches are also ripe for transformation.

The Building Block Approach

Banks should adopt fintech's modular ‘building block’ architecture, decoupling services and creating partnerships for non-core capabilities. This approach allows for faster innovation cycles but also reduces development costs. This means banks can focus resources on areas of genuine competitive differentiation.

By 2030, the financial services landscape will be defined not by winners and losers but by integrated ecosystems where traditional banks, fintechs, neobanks, and big tech collaborate to deliver great customer experiences. That’s a win for everyone, and particularly for customers!

Retail Banking Transformation

At Retail Banking Institute, our training programmes recognise that digital transformation can’t happen without cultural transformation. Training in Fintech Journeys and Fintech Revolutions form the core material in our management-level Associate International Retail Banker certification programme, as our guides to digital transformation for retail banks.

Call us or drop us a note today, and let’s see how we can help you prepare for the fast-arriving future.

Lafferty Group

Contact Us

enquiries@lafferty.com

caroline.hastings@lafferty.com

The Leeson Enterprise Centre

Altamont Street

Westport, Co. Mayo

Ireland

F28 ET85